Millennials need to inherit large sums of cash from dead elderly relatives in order to buy their own home and improve their quality of life.

That is according to the Institute for Fiscal Studies which published a report titled “Inheritances and inequality across and within generations” that looked at the economic stability and prospects of people across a diverse group of age ranges.

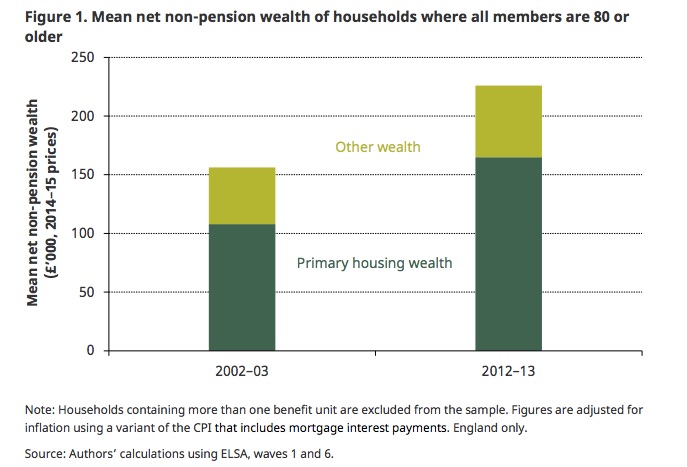

The key findings showed that the elderly has managed to accumulate an amount of wealth that will be difficult for other generations to replicate:

This is because they benefited from a high level of home ownership and massive rise in house prices over the last few decades. Just over the last years alone, house prices have rocketed:

Millennials - those aged from 18 to 32 - find it incredibly difficult to accumulate any substantial wealth because they cannot afford to save for a pension or gather assets, such as a home, due to stagnant household incomes.

For example, take a look at the ratio between what people earn compared to the price of buying a home - especially in London:

Notably, although all millennials will need an inheritance to help them in the future, naturally the ones from poorer families will suffer even more because their elderly relatives do not many assets to pass on.

All this combined means millennials need to wait until their elderly relatives die and hopefully pass on their cash and assets to them in order to get on the housing ladder and for social mobility.